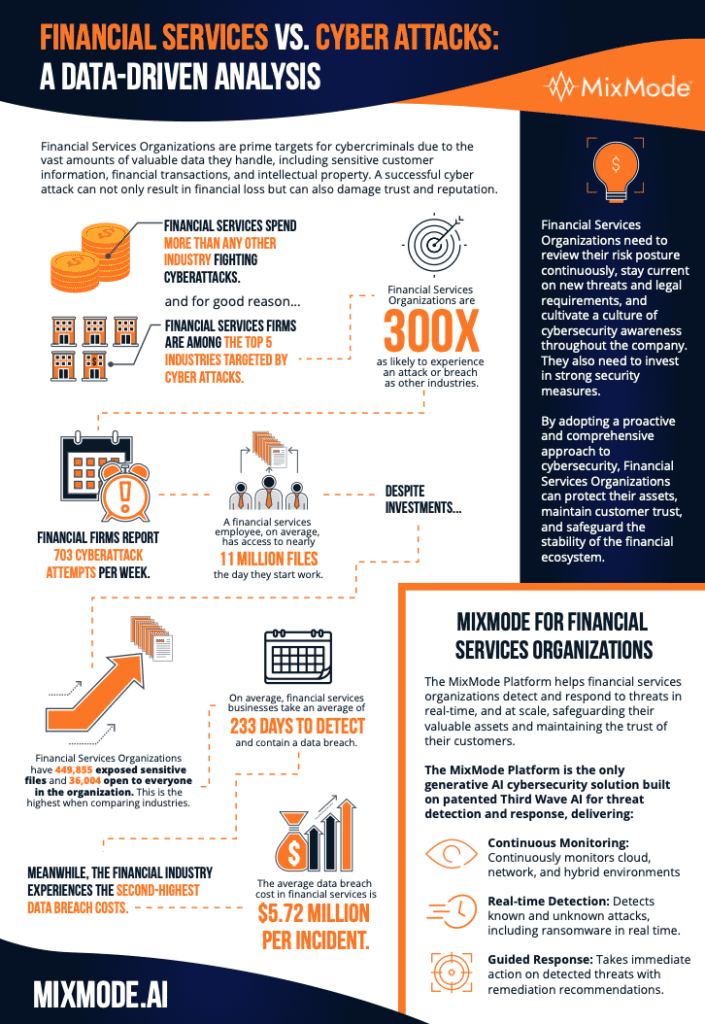

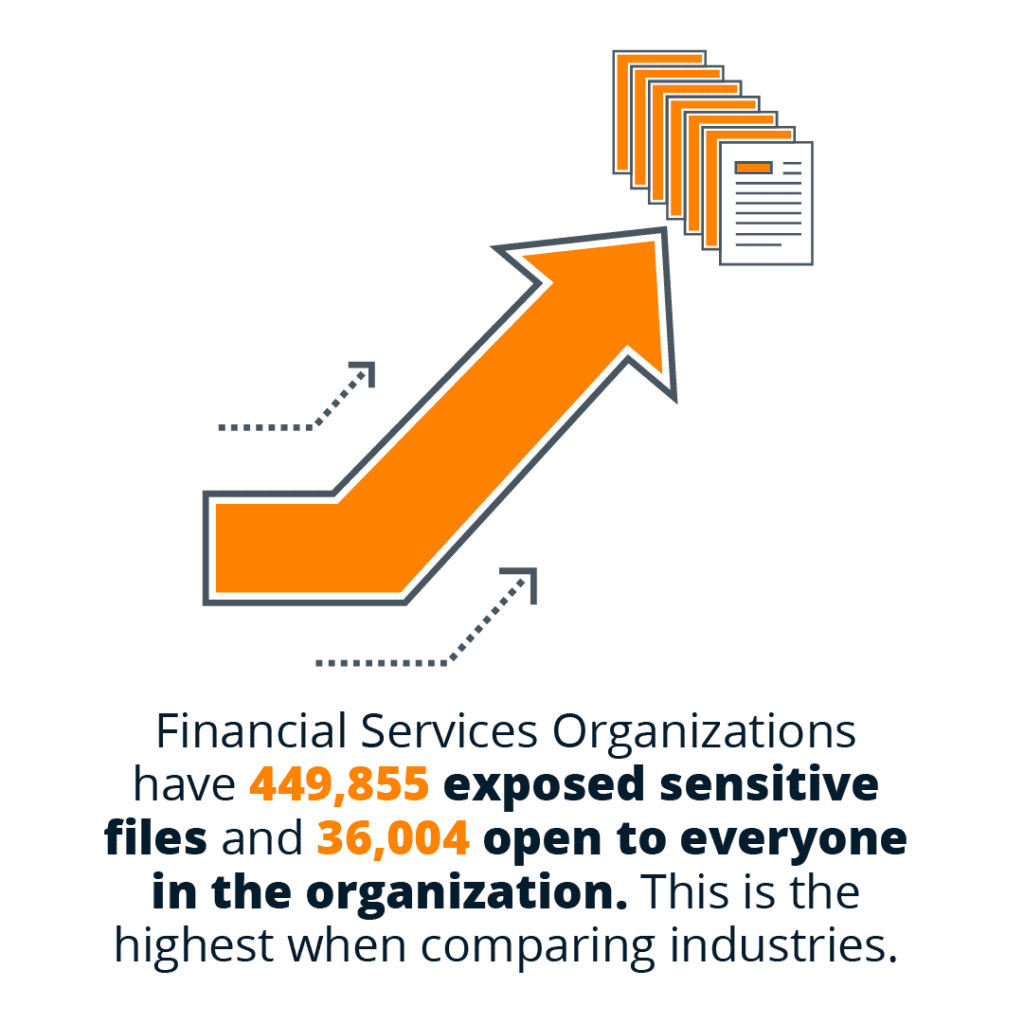

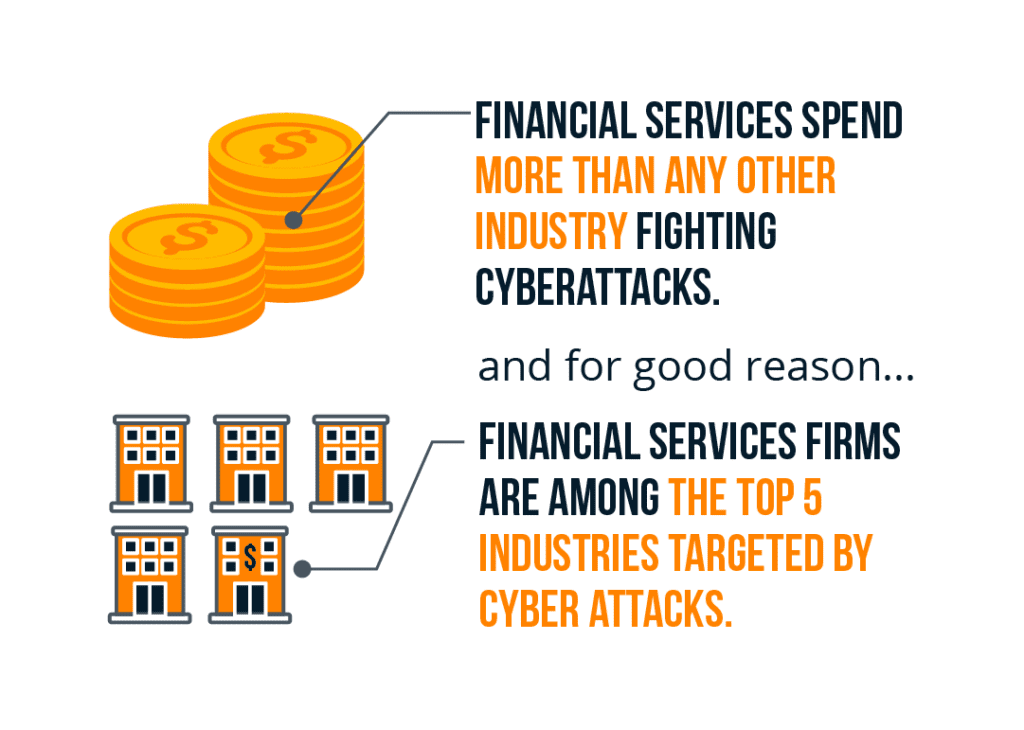

The financial services industry handles vast amounts of highly sensitive financial information, including customer data, transaction records, and intellectual property, making them a prime target for cyber attacks. Complicating matters further is that financial services firms often have multiple attack surfaces due to various networks, devices, applications, and users operating within their networks and are a highly targeted vertical.

This places a significant burden on security teams to ensure they have the most effective solutions to continuously monitor and detect targeted, sophisticated threats.

Types of Threats Financial Firms Face

Highly motivated threat actors continue to deploy multiple types of advanced attacks that pose significant risks, including:

- Ransomware attacks encrypt critical data and demand ransom payments, disrupting operations and potentially compromising sensitive customer information.

- Phishing and social engineering attacks deceive employees into revealing sensitive information or executing malicious actions.

- Malware attacks involve deploying malicious software that can compromise systems, steal data, or gain unauthorized access to financial information.

- Insider threats from malicious insiders can jeopardize the security posture of financial firms by intentionally leaking sensitive data or sabotaging systems.

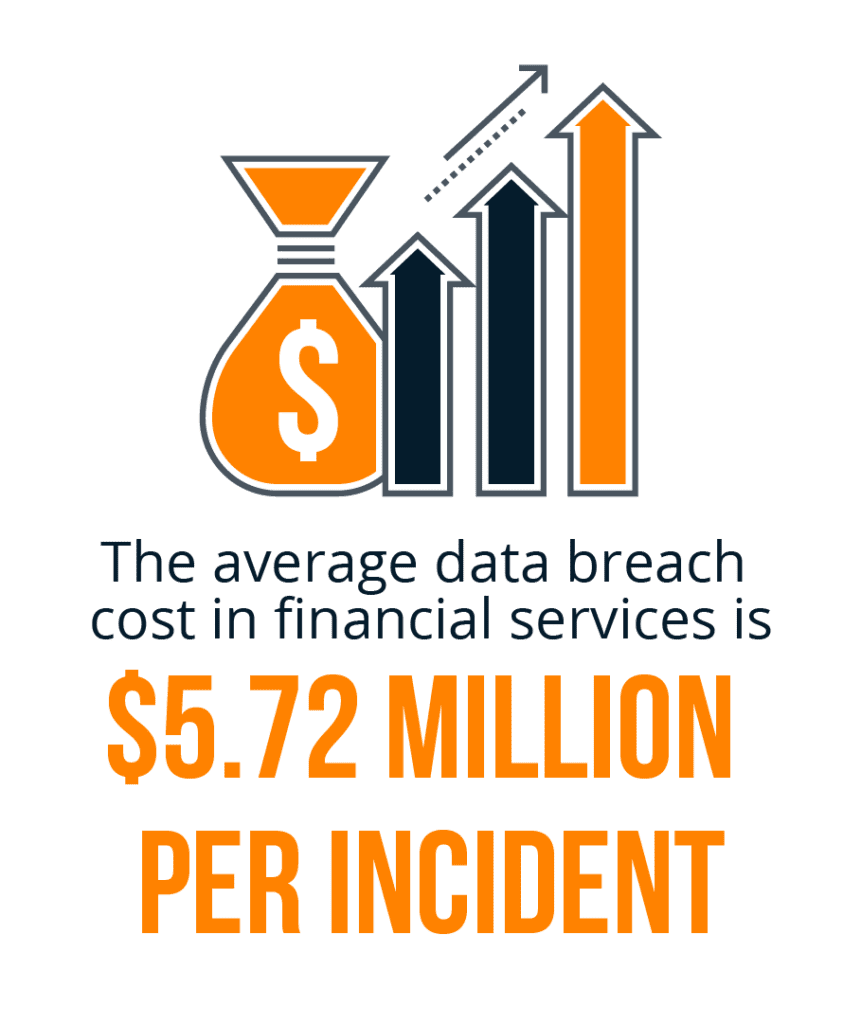

These threats can lead to severe cybersecurity risks for financial services firms, resulting in financial losses, reputational damage, regulatory penalties, and legal liabilities. Moreover, losing customer trust and confidence can have long-term adverse effects on the business.

Overview of recent attacks targeting financial services firms

The past few years have seen an alarming rise in disruptive attacks against banks, investment firms, insurers, and other financial institutions.

One high-profile example is the 2020 cyber heist, where attackers used compromised credentials and remote access tools to infiltrate Banco de Chile and trigger fraudulent SWIFT money transfers totaling $10 million. The attackers exhibited patience and stealthiness, evading the bank’s security through multiple phases of reconnaissance, lateral movement, and data exfiltration across ten months.

In 2022, the fast-spreading Qakbot malware infected hundreds of organizations globally. It enabled credential theft, data exfiltration, and ransomware payloads—initial access leveraged System vulnerabilities and phishing.

The 2022 Fidelity National Information Services breach further underscored risks to core banking infrastructure. Intruders accessed payment card data and related systems through compromised admin accounts. The breach went undetected for months enabling criminals to cash out stolen card data via online purchases.

Existing Security Measures and Their Deficiencies

A typical large financial services firm likely utilizes 25-50+ security tools from multiple vendors, either on-premises or in the cloud. This complex web of point solutions leads to tool sprawl, fragmented visibility, and integration challenges, leading to longer mean detection and remediation times. Existing security solutions utilized by financial services firms often include:

- Perimeter firewalls – Help defend against external attacks but focus only on network level and perimeter. Vulnerable to insider threats, cloud exposures, and credential theft.

- Antivirus – Effective for known malware signatures but misses new variants, fileless/zero-day attacks, and insider actions. Significant management overhead.

- Data Loss Prevention – Helps protect against data exfiltration but gaps with encrypted traffic. Hard to tune sensitively without impeding business.

- Web proxies – Provide visibility into web traffic but blind to expanding encrypted traffic volumes—excessive false positives.

- Vulnerability scanning – Important for hygiene but point-in-time and focused only on known CVEs. Misses zero days and logic vulnerabilities.

- Rules-based Analytics – Defines policies to detect known suspicious behaviors but are rigid and static. High false positives, easy to evade.

- Legacy SIEMs – Provide log correlation but generate excessive alerts. Rely on manual tuning/modeling. Costly to operate and scale.

- Cloud Access Security Brokers – Add visibility into the cloud, but security is limited—gaps with sanctioned apps and complex configurations.

- Employee Training – Important but not failsafe. Social engineering continues to breach trained employees. Insider risk also grows.

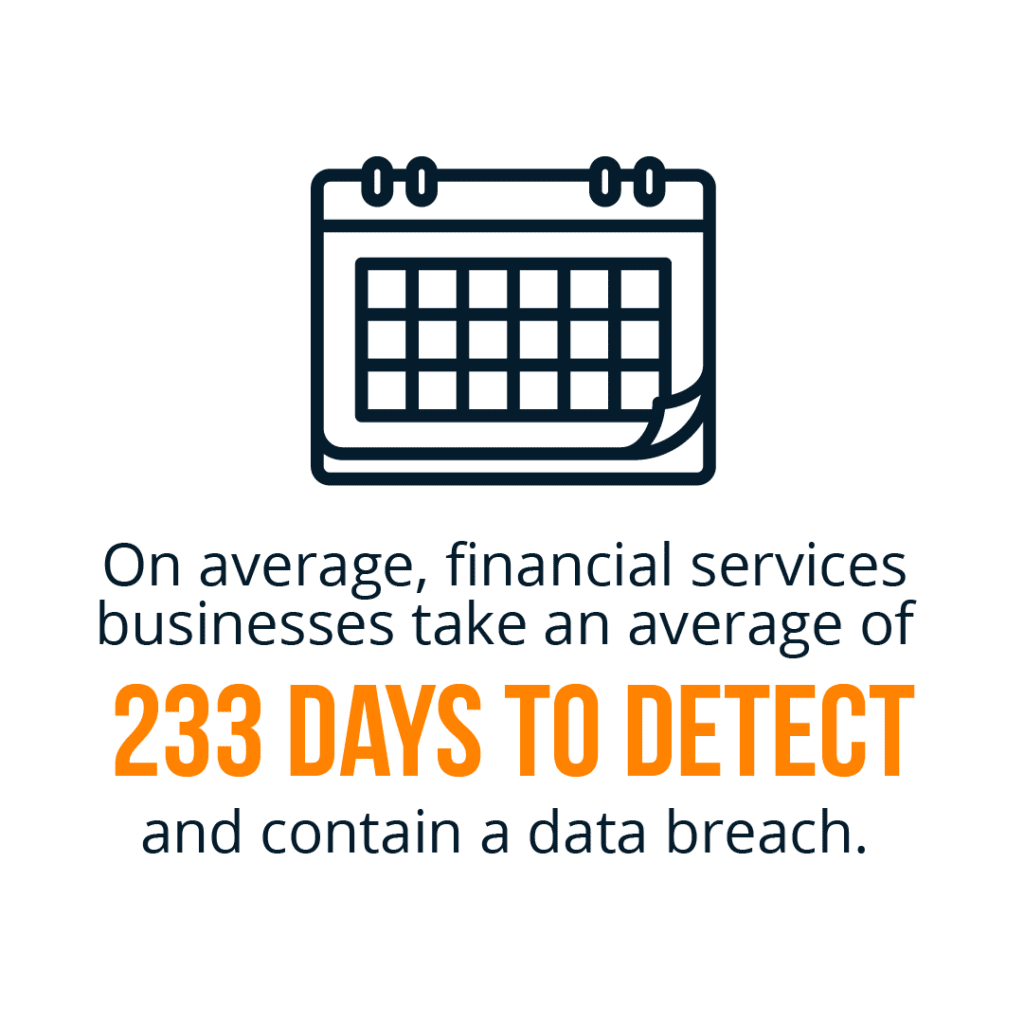

The common theme is these defenses apply single-layer, siloed protection against commoditized threats. Legacy solutions struggle to detect, investigate, and respond at the speed and complexity financial firms need today.

Moreover, these security solutions often lack real-time visibility, and continuous monitoring capabilities that advanced threats can exploit. They’re also limited in protecting against internal threats, i.e., malicious insiders, who may have legitimate access to sensitive data or networks.

While these solutions provide a certain level of protection, they struggle with detecting and mitigating advanced threats like zero-day or AI-generated attacks.

Understanding the Limitations of Current Solutions

To effectively detect and mitigate advanced threats, financial services firms need advanced threat detection solutions that provide complete visibility, advanced behavioral analytics, and continuous monitoring capabilities to detect and respond to sophisticated attacks promptly. User identity and access control measures should also be implemented to restrict unauthorized access and minimize potential threats.

As the reliance on cloud and digital solutions increase, the potential systemic impacts of cyberattacks also grow. The 2021 Solana crypto network outage, caused by transaction flooding from bots, led to service disruptions at digital asset exchanges and trading platforms built on Solana. While no funds were lost, it exemplified risks to emerging financial services capabilities.

Legacy security tools rely on rules, signatures, off-the-shelf ML, and manual processes, leaving them severely challenged against today’s attacks. These incidents and trends highlight why advanced, real-time threat detection is no longer just a nice to have but an absolute necessity for financial services firms.

Financial services firms must implement advanced technologies that can detect and mitigate threats in real-time due to the ever-evolving threat landscape and increasing sophistication of cyber attacks.

Identifying the Right Solution for Your Company’s Needs

Financial services firms need to consider several factors when identifying an appropriate advanced threat detection solution that meets their company’s needs.

First, they must evaluate their specific security requirements. Financial services firms handle sensitive customer data and transactions, making them prime targets for cybercriminals. Therefore, they require a solution prioritizing data protection, regulatory compliance, and secure financial transactions.

Second, these firms must consider the types of threats they face. Financial institutions are constantly exposed to many threats, including phishing attacks, ransomware attacks, and insider threats. They need an effective solution to promptly detect and respond to these threats.

Finally, financial services firms should evaluate their existing security measures. This includes assessing the effectiveness of their current toolsets. Identifying potential deficiencies in these measures will help determine the gaps an advanced solution needs to address.

Financial services firms must prioritize advanced solutions that align with their specific security requirements, address the threats they face, and complement their existing security measures. Considering these factors can help identify and implement an appropriate solution to enhance their security posture quickly and effectively.

The Need for Advanced Threat Detection

Advanced threat detection and response solutions focus on integrating artificial intelligence and machine learning (AI/ML) to enhance detection, speed response, bolster security expertise, and deliver unified visibility – obliterating the limitations of traditional rule-based security tools.

These solutions are pivotal in shrinking dwell time, reducing risks, and improving overall operational efficiency.

Key capabilities should include:

Real-time Threat Detection: Sophisticated threat actors like nation-states use novel techniques and “low and slow” tactics that are difficult for rules-based systems to catch. An effective solution should analyze patterns enterprise-wide to quickly spot anomalies indicative of emerging threats. This provides the best chance of detecting stealthy attacks in progress rather than after significant damage is done.

Automated Investigation and Response: The expertise gap makes responding to every security alert practically impossible, leading to missed threats. An effective solution should integrate automation that triages alerts, jumpstarts the investigation process, enriches with contextual data, and drives efficient response. It needs to ensure analysts are empowered to focus on the most critical threats rather than getting lost in the noise.

Cross-Correlated Visibility: Point solutions like EDR have limited scope for detecting multi-phase attacks spanning networks, cloud, email, endpoints, identities, and applications. An effective solution correlates insights across these layers to reconstruct full attack narratives from dispersed events and uncover attacks narrow tools miss in isolation.

Continuous Adaptability: Unlike static rules and signatures, an effective solution continuously models normal behavior to adapt detection to changing business patterns, users, and assets. This lessens dependence on labor-intensive manual processes or tuning as the organization and network evolve.

How MixMode Can Help

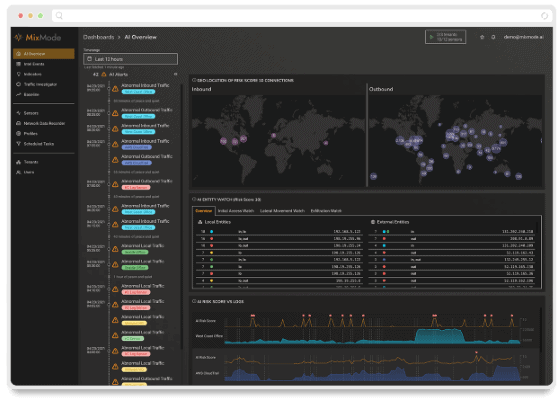

The MixMode Platform assists financial services organizations in detecting and responding to threats in real-time and at scale across on-prem, hybrid, and cloud environments, to protect valuable assets and maintain customer trust.

MixMode’s patented generative AI Platform is uniquely born out of dynamical systems (a branch of applied mathematics) and self-learns an environment without rules or training data. MixMode’s AI constantly adapts itself to the specific dynamics of an individual network rather than using the rigid legacy ML models typically found in other cybersecurity solutions.

The result is an adaptive real-time threat detection and response solution that dramatically enhances security programs, detects threats others miss in real-time, and delivers tangible business outcomes in days.

The stakes could not be higher for securing financial services. With advanced internal and external threats growing in sophistication, financial firms need real-time threat detection that keeps pace with the speed and complexity of modern attacks.

Other MixMode Articles You Might Like

Detecting the MOVEit Zero-Day: How MixMode AI Stays Ahead of Threats

Gartner Security & Risk Management Summit 2023 Recap

Understanding and Implementing Biden’s National Cybersecurity Strategy

Forbes Technology Council: Why Large Language Models (LLMs) Alone Won’t Save Cybersecurity